Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

04/19/2016, Paris

A promising start to 2016 - both in terms of performance and our own transformation. Organic growth in the first quarter of 2.9% was higher than expected and largely driven by accounts won at the end of 2015 and the good momentum in the media market. A highlight for the very good performance of Sapient whose 10+% growth which provides confirmation of its growth potential.

“We have made a promising start to 2016 - both in terms of performance and our own transformation. Organic growth in the first quarter of 2.9% was higher than expected and largely driven by accounts won at the end of 2015 and the good momentum in the media market. I would like to emphasize the very good performance of Sapient whose 10%+ growth provides confirmation of its growth potential.

With 55% of our revenue coming from digital, we are confident about our future but must remain cautious about the next two quarters which will be more impacted by losses that occurred in the 2015 media account reviews.

Our strategic exercise has led us to an adaptation of our organization to the 4th industrial revolution and our 2016 priority remains the finalization of our own transformation. Our clients’ interests have always been in our culture. We have known how to adapt regularly in order to better serve our clients and help them in the new digital environment.

Over the last ten years, we have been acquiring all the assets necessary to provide an end-to-end offering, from consulting to technology, in order to help our clients in the transformation of their own marketing and business models. To that end, we have deeply changed our own model. By this summer, this major undertaking should be finalized, with the complete disappearance of silos and holding company status. Publicis Groupe is becoming a “connecting company”, one that combines creativity and technology in an offering that is integrated, open-ended and flexible, thanks to its modular design.

Our objective remains achieving our three priorities: the completion of our organization by the end of the first half of 2016, the return to more usual levels of growth, and the continued improvement of our profitability.”

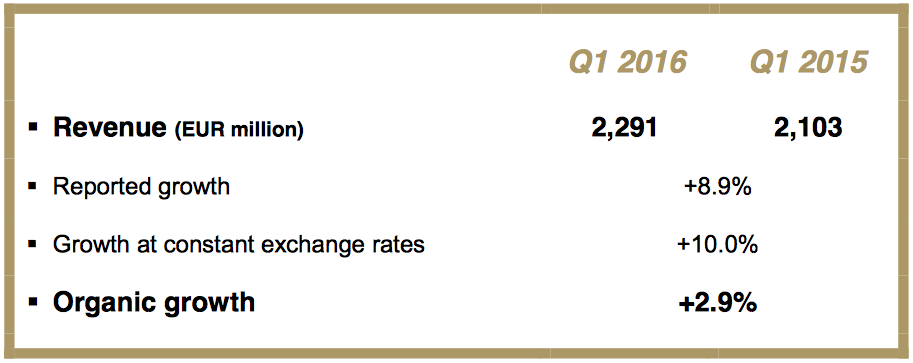

Publicis Groupe’s consolidated revenue for the first quarter of 2016 totaled 2,291 million euro, up 8.9% from 2,103 million euro in Q1 2015. Exchange rates had a 20 million-euro negative impact, i.e. 1% of Q1 2015 revenue. Net acquisitions contributed 147 million euro or 7.0% of Q1 2015 revenue. Growth at constant exchange rates was +10%.

Organic growth rose to +2.9% over the period, buoyed by digital (+7.6%) and good performance levels in Europe and North America, where the loss of media accounts in 2015 during the so-called "Mediapalooza" had only a moderate impact on Q1 2016. The impact will be bigger in quarters to come. Sapient, which has been included in the calculation of organic growth since February 6, 2016, posted organic growth of slightly above 10%. It should be noted that Healthcare performed well over the period. Media activities remained solid, a similar trend to Q4 2015.

Europe recorded growth of 7.3%. Net of acquisitions and the impact

growth stood at 3.4%. Digital activities progressed strongly in Europe, growing by 13.0%. Mention should be made of the good performance of France (+3.0%) and the very good momentum of Germany and Italy (growth of the order of 10%). Spain also improved, while the situation was volatile in Russia (+9.4%) but better in the UK compared with the sharp decline posted of previous quarters (-0.7%).

North America saw its revenue increase by 12.9%, achieving organic growth of 3.0%. This progress was mainly attributable to the media business, as the loss of media accounts during the "Mediapalooza" was only moderate in the first quarter. The impact will be bigger in quarters to come.

Asia Pacific reported revenue growth of 4.1% and organic growth of 3.8%, with notable performances in India (+8.6%) and mainland China (+4.1%).

Latin America saw revenue fall by 21.1% (organic growth of -3.1%) due to Brazil and Mexico (respectively -9.5% and -14.6%) where the situation remains difficult in both countries.

In the Middle East & Africa, revenue grew by 11.5%. Organic growth was +0.7%.

The Groupe’s growth continues to be driven by its digital activities (+7.6% organic growth), with double-digit growth achieved in all regions except North America where the Groupe is still encountering difficulties with Razorfish. It should also be noted that analog activities continued their decline.

Net debt stood at 2,864 million euro at March 31, 2016, compared with 2,966 million euro at March 31, 2015. The Groupe’s average net debt in Q1 2016 was 2,092 million euro, up from an average of 776 million euro in 2015, subsequent to the acquisition of Sapient on February 6, 2015.

3.1 – Reorganization

On December 3, 2015, Publicis Groupe announced its intention to become the most integrated organization in its sector, thus bringing down the curtain on the traditional silo-type structure of communications groups. It is about Publicis Groupe being able to help its clients face the challenges of transformation and marketing performance of its clients.

The purpose of this reorganization is to endow the Groupe with a client-centric structure. Four "Solutions hubs" dedicated to serve clients on a transversal basis have been created:

Publicis Communications, led by Arthur Sadoun, includes the creative and communication networks: Publicis Worldwide, Leo Burnett, Saatchi & Saatchi, BBH, MSL (public relations), and Prodigious (creative production);

Publicis Media, led by Steve King, covers the Groupe's media and connection capabilities: Starcom, Zenith, Mediavest ǀ Spark, Optimedia ǀ Blue 449 as well as performance units such as Performics;

Publicis.Sapient, led by Alan Herrick, includes consulting / technology / digital: SapientNitro, Sapient Consulting, DigitasLBi and Razorfish;

Publicis Health, led by Nick Colucci, caters all the solutions for the healthcare sector: DigitasHealth LifeBrands, Publicis LifeBrands, Saatchi & Saatchi Wellness, Publicis Health Media andTouchpoint Solutions.

All of these Solution hubs will directly address the Groupe's top 20 markets. For the other markets, Publicis One, led by Jarek Ziebinski, will serve clients in an integrated organization under one roof in each country.

Global clients will be served by Global Client Leaders (Chief Client Officers), coordinated by Laura Desmond, CRO.

The Publicis.Sapient and Publicis Health solutions are already fully operational. The other Solution hubs are largely operational as designed, the remaining adjustments will be completed by end of June 2016.

3.2 - Acquisitions

The IMF’s recent announcements on its revised growth outlook underscore the uncertainty of the global economic environment. Political instability in countries such as Brazil only add to this prospect. Despite this environment and the difficulties in certain sectors of the economy, Publicis Groupe is confirming its previous indications of an improvement of all its financial indicators: revenue, operating margin, adjusted diluted EPS, and dividend payout.

The Groupe’s transformation is the most radical ever imagined in its sector. It is being carried out in order to meet clients’ new requirements brought about by the fierce competition ushered in by the development of digital technology. Digital has not only empowered consumers, it has caused the physical and digital worlds to converge, with the emergence of numerous newcomers that are completely challenging the established order. Publicis Groupe has abolished the notion of holding company with silo-type operating structures and now provides a complete array of services from consulting right up to the materialization of campaigns through the alchemy of creation and technology.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. They are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the 2015 Registration Document filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavourable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, the difficulty of ensuring internal controls, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Volkswagen (China), Mondelez gum & candy (China), Wetherm (Greater China), Marubi (Greater China), Snapdeal (India), Yakult (Brazil), Carrefour (Brazil), Wine (Brazil), Movida (Brazil), Cadillac (USA), P&G Dish (USA), Acer Global (South Africa), Morrisons (UK), P&G (UK), Nestlé (UK), Belimo (Switzerland), Duracell International (Poland), Samsung / Brown Goods (Poland)

Shine Lawyers (Australia), Metricon Homes (Australia), EziBuy (Australia), AFL (Australia), Crosby Texter (Australia), BMBS/Daimler (China), DBS (Singapore/China/India), Shangri-La (China/Hong Kong), EDB (Singapore), Urban Clap (India), Gander Mountain (USA), Snapchat (USA), THE One (UAE/GCC), Lidl (Denmark), ORCHESTRA (France), VTECH (France), FinexKap (France), Generali (Switzerland), INLAC (Spain), Worten (Spain), Pepe Jeans (Spain), 4 Finance (Poland), SAB Miller (Poland), OBI (Poland)

Mastercard (Australia), Sunsuper (Australia), Pinpoint (Australia), Angie’s List (USA), Time Inc. (USA), Whole Foods (USA), Travelers (USA), Cardinal Health (USA), Genetech (USA), TransAmercia (USA), J Jill (USA), Silicon (USA), Starbucks (USA), CSM Bakery (USA), Manulife (Canada), Kering (UK), PGA Europe (UK), Congstar (Germany), Clinique Men (USA)

Acer (Indonesia), Electronic City (Indonesia), JDID (Indonesia), Scotiabank (Chile), Histadrut (Israel), Arkia (Israel), Mediamarkt (Turkey), BSH Ikiakes Syskeves A.B.E. (Greece), Nestlé (Greece), Newsphone Hellas (Greece), Dutch Government (Netherlands), Meetic (Netherlands)

13-01-2016 - Publicis Communications Announces Priorities & Key Appointments

28-01-2016 - Leadership change at Leo Burnett Worldwide

11-02-2016 - 2015 annual results

03-03-2016 - Publicis.Sapient acquires Vertiba, a Salesforce Gold Consulting Partner

10-03-2016 - MSL acquires Venus Communications Ltd in Vietnam

10-03-2016 - Publicis Media Unfolds Its Organisation Powered by Four Global Brands - Starcom, Zenith, Mediavest | Spark, and Optimedia | Blue 449

17-03-2016 - Publicis Groupe Partners with The Troyka Group in Nigeria

24-03-2016 - Publicis Groupe Launches Sapient Inside: The Combined Power of Publicis Communications and the Publicis.Sapient Platform

31-03-2016 - Publicis Groupe Named the Most Attractive Employer in the Services Sector by the Randstad Awards

31-03-2016 -Publicis One Announces its Global and Regional Leadership

EBITDA: operating margin before depreciation

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Net income group share: Group net income after elimination of impairment losses, amortization of intangibles from acquisitions, main capital gains and losses on disposal of assets, revaluation of earn-out payments and costs related to merger with Omnicom project and Sapient acquisition.

EPS (Earnings per share): Net income group share divided by average number of shares, not diluted. EPS, diluted (Earnings per share, diluted): Net income group share divided by average number of shares, diluted.

Capex: Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed): Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Net Debt (or financial net debt): Sum of long and short financials debt and debt-hedging derivatives linked with, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / EPS

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS