Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

10/17/2018, Paris

"The third quarter of 2018 was a solid quarter with (i) organic growth acceleration (ii) continued strong momentum in new business and (iii) a further advanced transformation”

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

"The third quarter of 2018 was a solid quarter with three key highlights. First, we delivered on the organic growth acceleration we have expected. Second, we continued our strong momentum in new business confirming the attractiveness of our model. And third, we further advanced our transformation to increase our competitive advantage.

Our organic growth for the third quarter was very satisfactory at +2.2%, excluding Publicis Health Services for which the divestment process has been launched following a strategic review. After a good first quarter and a bump experienced in the second quarter, we delivered an accelerated growth in the third quarter as expected. We have benefited from the first effect of our new business wins earlier in the year and the continuous growth of our game changers. All our geographies reported positive organic growth starting with North America up 1.0%, and Europe returning to growth at +4.2%. It is worth highlighting our organic growth in the US at +1.3%, a market where our new model has allowed us to largely overcome the challenge we are facing in creative activities.

Q3 was also a very strong quarter in terms of new business. The traction we are having with our clients when they are experimenting our model is impressive. They immediately understand how we can become a key partner in their transformation. In the last quarter we announced several wins such as Cathay Pacific globally, the Western Union worldwide creative budget, the Nestlé media account in Southeast Asia, the Government of Singapore, and the Mondelez International media budget in several markets. The latest win, GSK global media budget, is both emblematic and a concrete example of our attractiveness at a global level. As it has been confirmed publicly by the client, we won the 4 separate pitches thanks to our unique approach to data and our new platform model with Marcel at the core. We came with an original and innovative solution offering the best return on investment without hampering our own conditions.

Finally, this quarter was again productive when it comes to the acceleration of our transformation. So far, we are ahead on every strategic and operational KPI of the Sprint to the Future plan presented in March. We have also launched a review of our asset portfolio, which will optimize the allocation of our resources and help us scale our strategic game changers.

We are on track to deliver our 2018 objectives on growth, operating margin rate improvement and headline diluted EPS growth at constant currency. But even more importantly, I am confident that we have the right team, the right plan and the right organization to turn our industry’s challenges into opportunities for our people, our clients and our shareholders."

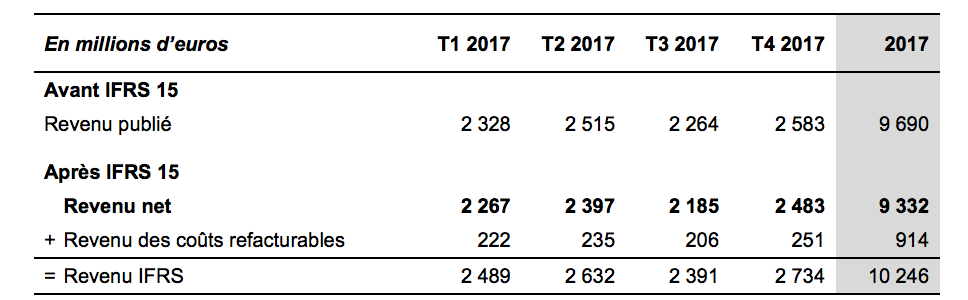

Publicis Groupe has applied IFRS 15, the accounting standard on revenue recognition, since it became effective on January 1, 2018. The 2017 financial statements have therefore been restated for the purposes of comparison with revenue since the standard came into force. This accounting standard increases IFRS revenue insofar as certain costs re-billed directly to clients are excluded from revenue. These costs mainly concern production activities as well as various expenses incumbent on clients

In this context, as the items that can be re-billed to clients do not come within the scope of assessment of operations, Publicis Groupe has decided to use a different indicator, revenue less pass-through costs or “net revenue”, which is a more relevant indicator to measure the operational performance of the Groupe’s activities.

The table below provides a detailed account of revenue reported for 2017 before the impact of IFRS 15, as well as the 2017 figures restated after applying IFRS 15, i.e. net revenue and revenue.

Details of 2017 net revenue by quarter and by geography, and the main items of 2017 half year and full year results before and after IFRS 15 impact, have been disclosed in a press release dated July 6, 2018 (available on our website: www.publicisgroupe.com).

Publicis Groupe has decided to early adopt IFRS 16 accounting standard as of January 1, 2018.

This accounting standard considers all lease contracts under a single model by which a lease contract is accounted for as a liability, and a right of use is accounting for as an asset.

The Group has disclosed 2018 half-year results with the application of IFRS 16 and has provided the financial data before taking into account this new accounting standard to allow performance comparisons with 2017. The same will be disclosed for 2018 annual results.

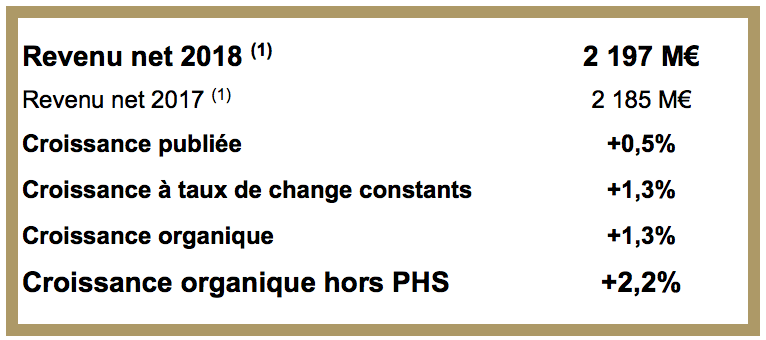

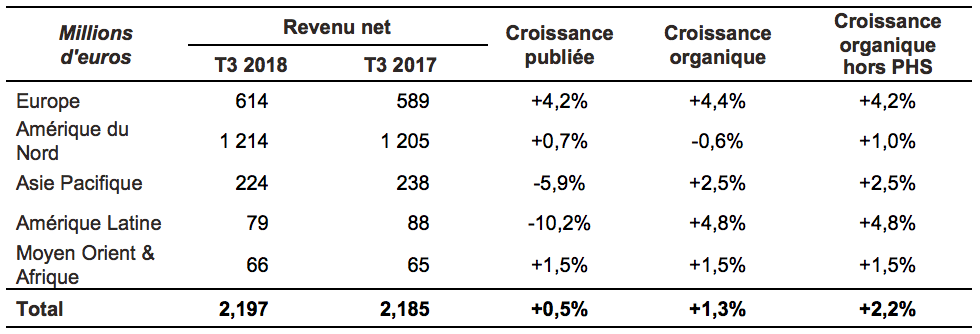

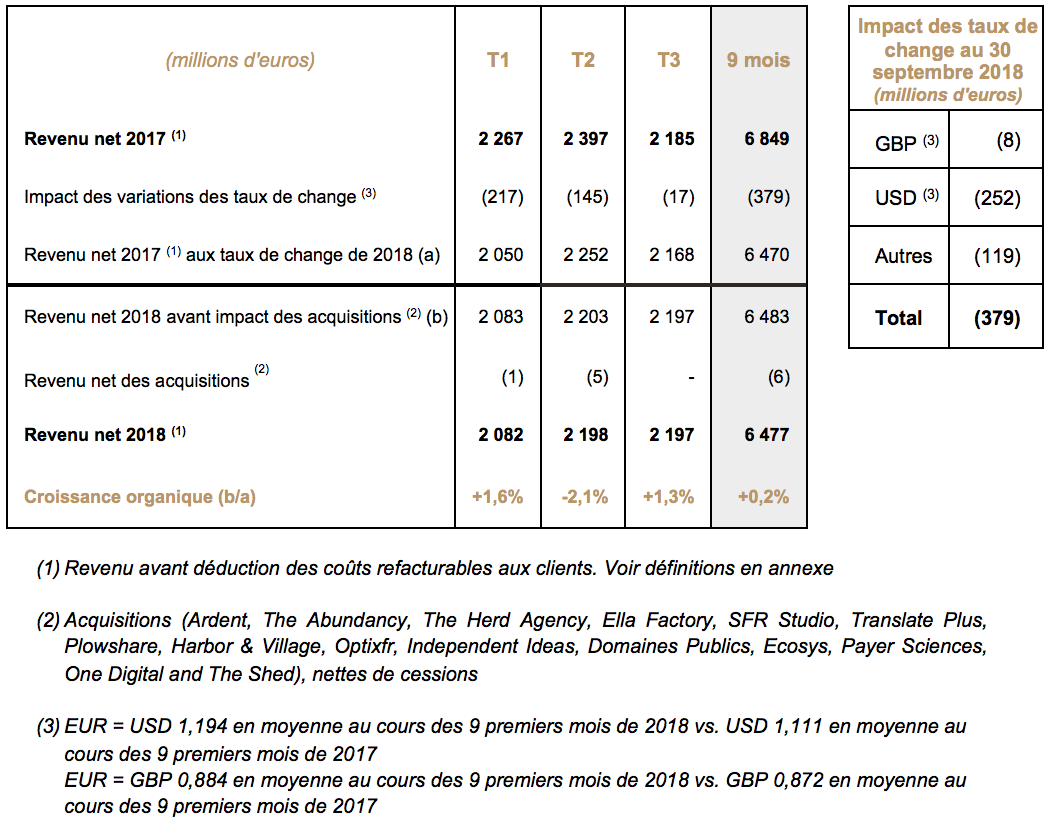

Publicis Groupe’s Net revenue in Q3 2018 was 2,197 million euro, up + 0.5% from 2,185 million euro in Q3 2017. At constant exchange rates, growth was +1.3%, but actual exchange rates had a 17 million euro negative impact, i.e. -0.8%. Net acquisitions made no contribution to Net revenue in Q3 further to the deconsolidation of Genedigi from January 1, 2018.

Organic growth was +1.3% in Q3 2018, compared with -0.4% over the first six months of the year. When PHS is factored out (divestment process underway), organic growth stood at +2.2% in Q3. This means that, without PHS, Publicis Groupe’s organic growth has accelerated by comparison with the +0.2% achieved in the first half of 2018, largely due to the contribution of accounts gained in Q1 2018, notably Daimler, Carrefour, Campbell’s and Marriott.

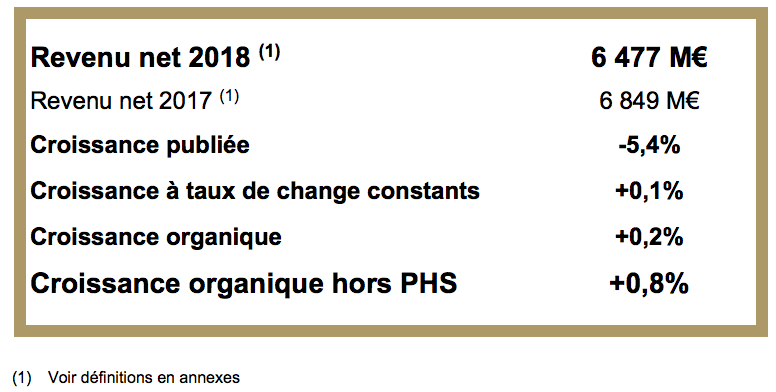

Publicis Groupe’s Net revenue for the first nine months of 2018 totaled 6,477 million euro, down 5.4% from 6,849 million euro for the corresponding period in 2017. At constant exchange rates, growth was +0.1% but the actual impact of exchange rates was a negative 379 million euro (-5.5%). Net acquisitions contributed (6) million euro to Net revenue over the first nine months, after the deconsolidation of Genedigi from January 1, 2018. Organic growth stood at +0.2% at September 30, 2018 and would have been +0.8% without PHS.

Europe was down 0.5% on a reported basis but, when changes in scope and exchange rates are factored out, organic growth was +0.2%. The acceleration observed since the end of June is mainly due to the ramp-up of accounts gained in the earlier part of the year, particularly Daimler and Carrefour. This is the broader context within which Germany returned to positive growth in the third quarter, whilst growth gathered momentum in France (+5.7% in Q3 after +0.7% at June 30, 2018), Italy (+9.2% in Q3 after -1.9% at June 30) and the UK (+10.4% in Q3 after +1.7% at June 30, 2018)

North America had organic growth of -0.1% at September 30, 2018. When the impact of PHS is factored out, organic growth stands at +1.1%, thanks to accounts awarded in 2017 (including McDonald’s, Diesel, Lionsgate, Molson Coors and Southwest) and the gain of Campbell's and Marriott in early 2018, and despite pressures in the creative business. North America is impacted by the difficulties encountered at Publicis Health Services where the impact of lower Net revenue was approximately 120 basis points on organic growth for North America over the first nine months of 2018. Given the impact of exchange rates, North America reported a 6.5% decline in Net revenue by comparison with the corresponding period in 2017.

Asia Pacific reported growth of -12.2% and organic growth of -1.4%. The lion’s share of this negative performance was due to Australia (-3.3%) which has been affected until end Q2 by the expiry of the Qantas call center management contract. Greater China recorded satisfactory growth of +0.4% despite the loss of certain accounts. Singapore saw its Net revenue rise by +3.3%. In Q3, Asia Pacific grew 2.5% organically

Latin America reported Net revenue down 9.2%, a decline that was mainly due to exchange rate variations, but achieved organic growth of +7.7%. Brazil saw its Net revenue progress by 5.1% thanks to the gain of the Petrobras et Bradesco accounts. Mexico continued to record sustained growth at +12.6%

The Middle East & Africa reported Net income in decline by 2.6% (due to exchange rate variations) despite organic growth of +3.5% driven by South Africa (+9.2%).

The pharmaceutical industry is undergoing radical transformation throughout the world. At a time when medical research and sales have moved on from the blockbuster era to one of more specialized therapies, it has become necessary to adapt its marketing and propose measures that target patients and prescribers much more specifically. Publicis Groupe’s offering – which is articulated around data, dynamic creativity and digital business transformation – is clearly aligned with these needs.

Publicis Groupe has a very distinctive positioning in the healthcare communications sector with Publicis Health Services (PHS) which services CSOs (Contract Sales Organizations), a business that does not exist in other healthcare communications networks as most of our competitors are specialized in outsourcing. By its very nature, this business is highly volatile and developments in the healthcare sector have led clients to make last-minute adjustments, including the postponement or even the cancellation of campaigns.

Publicis Health saw its Net revenue decline over the first nine months of 2018, mainly in its outsourcing business (PHS). Publicis Groupe is determined to provide its clients with the best possible offering for their digital transformation and will continue to invest in healthcare-related consulting, data and technology. After a strategic review of this activity, the Groupe has decided to proceed with the divestment of PHS and intends to protect the interests of all stakeholders.

Net debt - before IFRS 16 - totaled 1,834 million euro at September 30, 2018, compared with 727 million euro at December 31, 2017. The Groupe’s average net debt for the period was 1,499 million euro (before IFRS 16), down from an average of 2,066 million euro during the first nine months of 2017.

After IFRS 16, The Groupe’s net debt stood at 1,742 million euro at September 30, 2018 and its average net debt was 1,410 million euro.

Sprint To The Future

Since 2014 and the acquisition of Sapient, Publicis Groupe has undergone a deep transformation and is now uniquely positioned thanks to three key differentiators:

On March 20, 2018, Publicis Groupe presented its strategy and execution plan for 2018-2020 named Sprint To The Future. This plan is based on three pillars:

Further details can be found in the Groupe’s press release dated March 20, 2018:

The initial results are promising. Revenue generated by the strategic game changers rose 27% over the first six months of 2018, thus confirming the relevance of the Groupe’s strategic choices. Net revenue thus generated with the Top 100 clients amounted to 450 million euro, representing 18% of the Groupe’s total net revenue with its Top 100 clients over the period.

At June 30, Publicis Groupe had appointed 46 Global Client Leaders, compared with 35 at year-end 2017 and the target of 100 by 2020. The goal of having 100% of Net revenue organized under the “country model” was reached by the end of the first half year, with an organization articulated around eight key markets: France, UK, DACH (Germany, Austria and Switzerland), Central and Northern Europe, Southern Europe, North America, Latin America, Asia Pacific, and Middle East & Africa. This organization will accelerate the Groupe’s growth and the achievement of its productivity gains.

Headcount on the global delivery platforms reached 9,100 by the end of June, compared with 8,700 at year-end 2017.

An update on all those KPI will be provided early 2019 at the time of the release of the 2018 annual results.

All the Groupe’s energy is focused on the execution of its strategy with a view to delivering greater value to its clients, people and shareholders. A dedicated incentive plan, fully aligned with the financial objectives of the strategic plan, was implemented in late May for the group of executives entrusted with the execution of this plan.

Acquisitions & disposals

Publicis Groupe completed the disposal of Genedigi in the second quarter of 2018.

On July 17, Publicis Health announced the acquisition of Payer Sciences, a highly innovative agency using marketing strategies based on its considerable expertise in data analytics to support pharmaceutical groups in their dealings with reimbursement systems in the USA. This Morristown, New Jersey-based firm boasts a team of 40 data analysts who are experts in reimbursement systems and B2B communications.

On August 1, Publicis Communications announced the acquisition of One Digital, the Sao Paulo-based digital agency focusing on performance and creativity. One Digital was set up in 2003 but now counts 64 professionals working with Brazilian and international brands such as Agora (investment), American Express, Autoline (financial services), BitBlue (cryptocurrency), Bradesco (banking services), Next (online banking services), Norsh Hydro Brasil (aluminum production) and ShopFacil.com (e-commerce). The agency will be aligned with Publicis Communications which has a headcount of 1,700 in Brazil, all agencies combined (Arc, Deepline, DPZ&T, F/Nazca Saatchi&Saatchi, Leo Burnett, Tailor Made, MSL, Publicis Brazil, Prodigious, Sapient AG2, Talent Marcel and Vivid Brand).

Publicis Groupe remains focused on its three priorities: to deliver the financial results announced each year, to accelerate its transformation by developing its model at scale, and to create value for its shareholders throughout this period. The accounts gained in the first quarter have fulfilled their promise, producing higher organic growth in Q3 than during the first half of the year. The Groupe is thus confirming its guidance of higher organic growth in 2018 than in 2017. As for the Groupe’s margin, major cost savings are being pursued and part of the savings achieved will be reinvested to pave the way for sustained future growth. The Groupe is banking on a 30 to 50-bps improvement of its operating margin and on 5% to 10% annual growth of its headline diluted EPS, at constant exchange rates.

In the longer term, Publicis Groupe intends to deliver greater value to shareholders by accelerating the growth of its headline diluted EPS over 2018-2020, using three levers:

The objective is to accelerate organic growth in 2018-2020 with the ambition of achieving +4% by 2020.

Publicis Groupe is also aiming to increase its operating margin rate by 30 to 50 basis points a year through to 2020. This objective includes a 450-million-euro cost savings plan fully aligned with the Groupe’s strategy. This cost savings plan will serve to fund a 300-million-euro operational investment plan spanning 2018-2020, a plan that is primarily dedicated to the Groupe’s talent through hiring, training, development and re-skilling.

Publicis Groupe is targeting 5% to 10% annual growth of its headline diluted EPS, ramping up over the next three years, at constant exchange rates, through continuous enhancement of its organic growth, improved margins and contribution of acquisitions to earnings.

Free cash flow generation is expected to remain strong and the balance sheet will remain solid. With a payout ratio in the region of 45%, dividend growth can be expected to accelerate over the next three years.

This enhanced financial performance will place Publicis Groupe at the forefront of the market in marketing and business transformation.

The objective is to accelerate organic growth in 2018-2020 with the ambition of achieving +4% by 2020.

Publicis Groupe is also aiming to increase its operating margin rate by 30 to 50 basis points a year through to 2020. This objective includes a 450-million-euro cost savings plan fully aligned with the Groupe’s strategy. This cost savings plan will serve to fund a 300-million-euro operational investment plan spanning 2018-2020, a plan that is primarily dedicated to the Groupe’s talent through hiring, training, development and re-skilling.

Publicis Groupe is targeting 5% to 10% annual growth of its headline diluted EPS, ramping up over the next three years, at constant exchange rates, through continuous enhancement of its organic growth, improved margins and contribution of acquisitions to earnings.

Free cash flow generation is expected to remain strong and the balance sheet will remain solid. With a payout ratio in the region of 45%, dividend growth can be expected to accelerate over the next three years.

This enhanced financial performance will place Publicis Groupe at the forefront of the market in marketing and business transformation.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements and forecasts are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the Registration Documents filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets

Publicis Groupe has applied IFRS 15 “Revenue” accounting standard since January 1, 2018. Details of 2017 quarterly and full year revenue before and after IFRS 15 impact, 2017 net revenue by quarter and by geography, and the main items of 2017 half year and full year results before and after IFRS 15 impact, have been disclosed in a press release dated July 6, 2018

Publicis Groupe has applied IFRS 16 “Leases” accounting standard in advance, as of January 1, 2018. Publicis has retained the “prospective method” allowed by the accounting standard by which the cumulative effect of the standard will be accounted for as an adjustment to the opening equity, considering the “right of use” asset equals the amount of the lease commitment, adjusted for rents paid in advance. The opening balance sheet with the application of IFRS 16 as of January 1, 2018 have been disclosed in a press release dated July 6, 2018. Besides, the 2017 consolidated income statement will not be restated. The Group has disclosed 2018 half-year results with the application of IFRS 16 and has provided the financial data before taking into account this new accounting standard to allow performance comparisons with 2017. The same will be disclosed for 2018 annual results.

Net revenue (1): organic growth calculation

Tea (China), Carrefour (China), Luzhou Laojiao, Whitail (China), Adobe (India), Asics (Singapore), P&O Ferries Holdings (UK), Department of Transport and Main Roads - Queensland Government (Australia), Lapp Holding AG (Germany), Hotwire (USA), Sentosa (APAC), ABInBev (USA), Muthoot Pappachan Group (India), Kraft Heinz (China), Tourism Fiji (Global), Red Bull (Brazil), Mentos & Fruittella (Brazil), Hamburger Hochbahn AG (Germany), Tourism Ireland (UK), Brand Factory (India), Monte Carlo Fashions (India), Betway (Global), Atlantis Bahamas (Global), Western Union (Global), Burger King (UK), Cathay Pacific (Global)

7Travel (Australia), Aberdeen Asset Management (Taiwan), Abu Dhabi DCT (UAE), Aisance (Thailand), Almara (Middle East), American Standard (Singapore), Amplifon New Zealand (New Zealand), Avanir (USA), Banyan Tree Group (Global), Betadine Throat Spray (Thailand), Campbell Arnott's (Australia & NZ), Campbell's Soup Company (North America), Che Tai International (Taiwan), Clarins Group (France), Clas Ohlson (Norway), Didi Chuxing (China), Dubai Corporation for Tourism & Commerce Marketing (UAE), Easy Rent (Toyota) (Taiwan), Elizabeth Arden (China), Etisalat Misr (Egypt), GAC Group (China), Heineken (Taiwan), Henryk Kania (Poland), Hyderabad (HIL) Industries (India), Iberdrola (Norway), IQIYI (Taiwan), Khumo Tyres (Australia), Laneige (Amorepacific Group) (Taiwan), Lionsgate Entertainment (Mexico), Lucano Group (Italy), Marriott International (Global), Marti Derm (Bonaquet) (China), Maspex (Poland), Mcdonald's (Middle East), Metro-Goldwyn-Mayer Studios (USA), Mondelez International (North America), Telemundo (USA), NIIT Ltd. (India), Ola Cabs (India), Pierre Fabre (China), Pizzardi Editore (Italy), Porter (Taiwan), Puig (Argentina), Red Bull (USA), Shopee (Taiwan), The Body Shop (Singapore), Victorian Electoral Commission (Australia), ZEE5 (India), Akash Institute (India), Alfa Romeo (China), Allianz (Taiwan), Canon (Hong Kong), Comvita (Hong Kong), Costa Coffee (UK), DTCM (UAE), Diamond Producers Association (China), Didi (Australia), Discover Hong Kong (Taiwan), Dunkin Donuts (USA), Ego Pharmaceuticals (Taiwan), ENI (UAE), Football Federation Australia (Australia), Fuji Pharma (Taiwan), Galderma (Hong Kong, India), Genentech Inc (USA), Glovo (Italy), GOME Electrical Appliances (China), HDFC Life (India), IKEA (Middle East), Ixigo (India), Jacobson Medical (Hong Kong), Line Corporation (Thailand), Lion & Globe (Hong Kong), L'Oreal (LATAM), Macy's (USA), Mcdonald's (France), Midland Realty (Hong Kong), Universal Kids (USA), Nonno Nanni (Italy), P&O Ferries (EMEA), PTT Exploration and Production (Thailand), Royal Carribbean Cruises (Hong Kong), Sensee (France), Singha Estate (Thailand), SRL Diagnostics (India), Starbucks (Singapore), TAITRA (Taiwan), Tencent - JOOX (Hong Kong), Thai Life (Thailand), WAVO (UAE), Welspun (India), Whitbread (UK), Driven Brands (USA), Far East Tone (Taiwan), Lenovo (Global), Mcdonald's (LATAM), Mondelez International (APAC), NestBank (Poland), Nestle (Singapore), Panera (USA), Peter's Ice Cream (India), Procter & Gamble (Australia, NZ, Russia), Spykar (India), Starbucks (Canada), Welspun (India), Yamaha (India)

Carrefour (Global), Marriott International (Global), Mercedez Benz (Global), Education Corporation of America (USA), Medtronic (USA)

Alexion Pharmaceuticals (USA), AVANIR Pharmaceuticals (USA), DBV Technologies (USA), Eli Lilly & Co. (USA), Galderma (USA), ParatekPharmaceuticals (USA), Pfizer Inc. (UK & USA), Roche (USA), Astrazeneca (USA), Bayer (USA), Bristol-Myers Squibb (USA), EyePoint Pharmaceuticals (USA), Masimo Corporation (USA), Merck & Co. (USA), Novo Nordisk (USA), Merz Aesthetics (USA), Proctor & Gamble (USA), Rhythm Pharmaceuticals (Europe), Sarepta Therapeutics (USA), Allscripts (USA), Edwards LifeSciences (USA), Endo Pharmaceuticals (USA), Gilead Sciences, Inc. (USA), Purdue Pharmaceuticals (USA), Tris Pharma, Inc. (USA), UPMC BigData (USA), Urovant Sciences (USA)

05-01-2018 Publicis Groupe half-year financial statement liquidity contract

22-01-2018 Nick Law Joins Publicis as Chief Creative Officer of Publicis Groupe and President of Publicis Communications

23-01-2018 Carrefour group signs strategic partnership with Publicis.Sapient to accelerate its digital transformation

23-01-2018 Press release “Anonymous Letter”

29-01-2018 Publicis Groupe and Microsoft Announce Partnership for Marcel AI Platform

01-02-2018 Publicis Groupe Announces Global Leadership Promotions Across its Solutions & Regions

01-02-2018 Loris Nold appointed to the newly created role of CEO of Publicis Groupe APAC

01-02-2018 Alexandra von Plato Appointed Chief Executive Officer of Publicis Health

08-02-2018 Publicis Groupe : 2017 Annual Results

14-02-2018 Viva Tech 2018

14-02-2018 Leo Burnett Chicago Names Kieran Ots EVP, Executive Creative Director

26-02-2018 Robett Hollis and FrontSide join Saatchi & Saatchi New Zealand

28-02-2018 Saatchi & Saatchi New Zealand wins global Tourism Fiji account

05-03-2018 Brill and Crovitz announce launch of NewsGuard to fight fake news

20-03-2018 Publicis 2020: Sprint To The Future

27-03-2018 Publicis Groupe Named 2018 Adobe Experience Cloud Partner of the Year

29-03-2018 Publicis Media launches Global Commerce capability to manage the intersection of media and marketplaces

10-04-2018 Leo Burnett wins international Betfair account

19-04-2018 Publicis Groupe: Q1 2018 revenue

23-04-2018 2017 Registration Document available

25-04-2018 Publicis Groupe appoints leadership team to lead Indian market

30-04-2018 Publicis Media aligns EMEA & APAC markets under unified leadership

24-05-2018 Publicis Groupe unveils Marcel

28-05-2018 Combined General Shareholders’ Meeting

13-06-2018 Tom Kao appointed as Publicis Groupe Hong Kong CEO

22-06-2018 Publicis Groupe clients champion creativity in Cannes

26-06-2018 Publicis Groupe appoints Raja Trad to the newly created role of Chairman Middle East

03-07-2018 Publicis.Sapient boosts digital business transformation capability with global engineering executive hires

04-07-2018 Statement

06-07-2018 Impact of application of IFRS15 and IFRS16 accounting standards

12-07-2018 Publicis Groupe Expands its Country Model to Cover All of its Markets

17-07-2018 Lenovo Appoints Publicis Media Bespoke Unit to Handle Global Media Strategy, Planning and Buying

17-07-2018 Publicis Health Acquires Payer Sciences

18-07-2018 Publicis Groupe Appoints Leader in Ukraine

18-07-2018 Publicis Groupe: First Half 2018 Results

01-08-2018 Publicis Communications acquires One Digital in Brazil

03-08-2018 Overview of the share buyback program authorized by the Combined Ordinary and Extraordinary General shareholders’ Meeting of May 30, 2018

03-08-2018 Half-year financial report ended June 30,2018

07-08-2018 Publicis Groupe pays tribute to Joël Robuchon

08-08-2018 Publicis Groupe announces new appointments in Israel

05-09-2018 Publicis Groupe announces leadership appointments in Russia

12-09-2018 The Publicis Groupe Management Board

18-09-2018 Publicis Media agencies named a leader and a strong performer by independent research firm

20-09-2018 Publicis Media advances commerce practice with regional leadership appointments

26-09-2018 Publicis Groupe announces leadership appointments in poland

Net revenue or Revenue less pass-through costs: Pass-through costs mainly concern production and media activities, as well as various expenses incumbent on clients. These items that can be re-billed to clients do not come within the scope of assessment of operations, net revenue is a more relevant indicator to measure the operational performance of the Groupe’s activities.

Organic growth: Change in net revenue excluding the impact of acquisitions, disposals and currencies.

EBITDA: Operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities less interests paid & received, repayment of lease liabilities & related interests and changes in WCR linked to operating activities

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS